What Is WeBull?

Webull is a newcomer among investment brokers. The company began operations in 2018, but it’s quickly become popular because it’s an online and mobile trading app that provides commission-free trade.

It’s a fairly limited platform, designed for specialized trading, including day trading. You can trade only in stocks, options, and exchange traded funds (ETFs). But they are also planning to roll out trading in cryptocurrencies in the near future. When they do, they’ll have a major competitive advantage over more traditional investment brokers who don’t offer cryptos.

Because it is so specialized, it’s the kind of platform best use by intermediate and advanced traders, who don’t need customer support and feel comfortable making their own trading decisions.

Despite being only about two years old, Webull has a rating of 4.3 stars out of five by well over 58,000 users on Google Play, and 4.7 out of five stars by more than 38,000 users on The App Store.

Webull Options

Webull Accounts Available

Webull offers taxable brokerage accounts, as well as traditional, Roth and rollover IRA accounts. (To open an IRA account, you must first open and be approved for a taxable brokerage account.)

However, be aware that they do not offer custodial, trust, or even joint accounts. Each account is available only in a single individual’s name.

Accounts are available to residents of all 50 US states.

Minimum Initial Investment

None for a regular cash account – but you obviously need funds in your account to begin investing.

Margin accounts will require a minimum of $2,000 to begin trading on margin.

Available Investments

Webull offers trading in stocks, options, and ETFs. Though they don’t permit direct trading in foreign stocks, you can invest in foreign companies through American Depositary Receipts (ADRs). Also, Webull does not support trading in fractional shares.

The company will soon be offering trading in cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

Trading Hours

In addition to trading during regular market hours, Webull also offers pre-market and post-market trading.

You can begin trading at 4:00 am, and as late as 8:00 pm, on regular trading days (all times Eastern).

Webull Mobile App

The Webull Mobile App has all the functionality of the desktop version.

It’s available on The App Store for iOS devices, 10.0 or later, and is compatible with iPhones from 5S and higher. It’s also available for Android devices on Google Play. The Webull Mobile App has been installed on more than 5 million devices on each platform.

Customer Support

Customer support is available by both email and by phone. However, the platform also offers online help on a 24/7 basis.

How Webull Works

Webull offers two basic accounts, Cash Accounts and Margin Accounts. Cash Accounts are available for individual taxable investment accounts and are required for IRA accounts. Margin Accounts are available only for individual taxable investment accounts.

The Cash Account requires no minimum initial investment or ongoing balance requirement. You will of course need funds in the account to begin investing.

Margin Accounts enable you to borrow through your account to purchase securities. You can open an account with no money, but you will need a minimum of $2,000 to take advantage of the margin provision.

With at least $2,000 in your Margin Account, you will have up to 4X day trading borrowing power, and 2X with overnight trading.

For unlimited day trading, you will need either a Cash Account, or a Margin Account with a balance of at least $25,000, otherwise activity will be limited.

The differences between the Cash and Margin Accounts are summarized in the table below:

| Account Type | Net Account Value | Day Trade | Margin Trade | Short Selling |

|---|---|---|---|---|

| Cash account | Unlimited | Unlimited | No | No |

| Margin Account | $0-2000 | 3 day trades in 5 business days | No | No |

| Margin account | $2,000-25,000 | 3 day trades in 5 business days | Day trade: up to 4 times | Yes |

| Margin Account | > $25,000 | Unlimited | Overnight: up to 2 times | Yes |

To be able to trade securities, they must be listed on US stock exchanges.

The trading platform offers the following investor tools:

Trading screen, where you can buy and sell, enter the order type and quantity, and set stop limits.

A paper trading screen, where you can test out your investing skills before going live with real money.

A stock screener, providing information on pricing, volume, average three-month volume, market capitalization, price-earnings ratio, dividend yield, earnings per share, 52-week high and low prices, and various technical indicators for each security. It also provides

Gap candlestick patterns, where you can use price gaps to identify the price support and resistance levels.

Watchlist, where you can add all the securities you’re following.

News that automatically changes when you switch to a different watchlist, providing the latest update on the companies on each list.

Is Webull Safe?

When you open a Webull account, you don’t need to be concerned with account security. Webull accounts are protected by SIPC insurance, for up to $500,000 in cash and securities, including up to $250,000 in cash.

Since your account is held by Apex Clearing as the custodian, you’ll also have additional coverage. That will include protection for securities and cash up to an aggregate of $150 million, subject to maximum limits of $37.5 million for any one customer’s securities, as well as up to $900,000 for any one customer’s cash.

As is the case with all investment accounts, the insurance coverage provides protection only against broker failure. It does not extend to market losses on investments you’ve made.

Webull Pricing

Webull charges no commissions when you trade in stocks, options, or ETFs. However, there are certain regulatory fees charged on the purchase and sale of all three, as follows:

| Trading Privileges | Charged By | Types | Fees | Rule |

|---|---|---|---|---|

| Stock/ETF | The U.S Securities and Exchange Commission (SEC) | Transaction Fee | $0.0000221*Total $ Trade Amount (Min $0.01) | Sells Only |

| Stock/ETF | Financial Industry Regulatory Authority (FINRA) | Regulatory Fee | 0.000119* Total Trade Volume Min $0.01 per - Max $5.95 per | Sells Only |

| Stock/ETF | The U.S. Securities and Exchange Commission (SEC) | Transaction Fee | $0.0000221* Total $ Trade Amount (Min $0.01) | Sells Only |

| Options | Financial Industry Regulatory Authority (FINRA) | Trading Activity Fee | $0.002* No. of Contracts (Min $0.01) | Sells Only |

| Options | Options Exchange | Options Regulatory Fee | $0.0388* No. of Contrcts | Buys & Sells |

| Options | Options Clearing Corp (OCC) | Clearing Fee | $0.055* No. of Contracts (Max $55 per trade) | Buys & Sells |

American Depositary Receipts (ADRs) fees: ADRs are used to trade stocks listed on foreign exchanges. The fee for ADR trades of between $0.01 and $0.03 per share will apply.

Other fees:

- ACH deposits and withdrawals, free

- Deposit by US domestic wire, $8

- Withdrawal by US domestic wire, $25

- Deposit by international wire, $12.50

- Withdrawal by international wire, $45

- IRA account fee, none to open, maintain or close an account

- Stock transfers, no fee to transfer stock into Webull, $75 to transfer them out

Margin and short interest rates:

| Debit Balance | Annual Margin Rate |

|---|---|

| $0-25,000.00 | 6.99% |

| $25,000.01 - 100,000.00 | 6.49% |

| $100,000.01 - 250,000.00 | 5.99% |

| $250,000.01 - 500,000.00 | 5.49% |

| $500,000.01-1,000,000.0 | 4.99% |

| $1,000,000.01 - 3,000,000.00 | 4.49% |

| > $3,000,000.00 | 3.99% |

Webull Promotions

Webull wants your business! Sign up now, and you can take advantage of one of the following two promotions:

Webull Free Stock Promotion

Webull free stock is available on cash accounts and margin accounts only, but not IRAs. To be eligible, it must be your first Webull brokerage account, and include your social security number. The application must be submitted within 24 hours of signing up.

The Webull free stock given will be valued at between $2.50 and $250 per share. However, if you make an initial deposit of $100 or more within 30 days of signing up for an account, the Webull free stock will be valued at between $12 and $1,400. You can claim your stock within 30 days after it becomes available.

Webull free stocks are in US-based companies with a minimum market capitalization of $2.5 billion, and trading on the New York Stock Exchange or NASDAQ. You’ll have 30 days to claim your stock, which will be credited to your account within seven trading days after it’s claimed. Once you receive your stock, it will be yours to either hold or sell at your discretion.

Earn Up to $330 Just for Opening a New IRA Account

IRA accounts are specifically excluded from the Webull free stock promotion offer. But Webull has a bonus designed specifically for new IRA accounts.

While the promotion is in effect, you’ll receive an Amazon gift card by depositing the following amounts into an IRA account:

- $5,000 to $9,999 – $50

- $10,000 to $24,999 – $110

- $25,000 to $99,999 – $220

- $100,000 or more – $330

The funds must be deposited into your account within 45 days of opening, and must remain there for a minimum of six months.

Webull will also reimburse you for up to $100 in transfer fees for an initial IRA account transfer of $5,000 or more.

How to Open an Account with Webull

You’ll need to meet the following qualifications to open an account with Webull:

- Be 18 years or older.

- Have a valid Social Security number.

- Have a legal residential address in the US and outlying US territories.

- Be a US citizen, US permanent resident, or have a valid US visa.

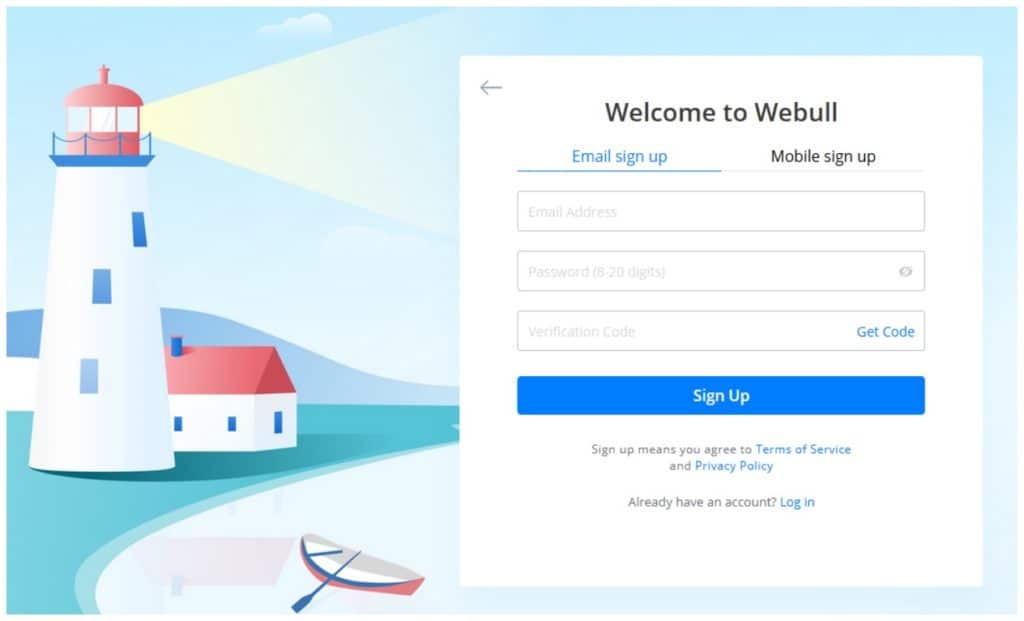

You’ll begin the sign-up process by entering your email address and creating a password. You’ll be provided with a verification code, which you will need to enter to continue.

The application process itself will take about an hour. But Webull may request additional documentation, causing the process to take a bit longer. At a minimum, you’ll need to provide a government-issued ID card with your photo, name, and date of birth to verify your identity.

If you’re going to open an IRA account, you must first open a regular, taxable brokerage account. Your IRA can be opened once your brokerage account has been approved.

You can fund your account by linking an external bank account. Once you link the account, Webull will perform two micro deposits, which you must verify to confirm the connection with your account. The linked bank account must be a US-based institution only.

If you use a wire transfer, the funds will be moved into your Webull account within between one and five business days. But you can also use ACH, which will take up to seven days.

Webull Advantages and Disadvantages

Webull Advantages:

- Commission-free trading of stocks, options, and ETFs.

- There is no minimum initial account required.

- You’ll get free stock when you open a taxable investment account.

- You can earn up to $330 in Amazon gift cards when you open an IRA account, plus reimbursement for up to $100 in transfer fees if you transfer at least $5,000 into the account.

- The platform is designed specifically for investors looking for day-trading, margin accounts, and short sales.

- Webull offers a trading simulator to help you up your investment game.

- Margin accounts offer up to 4X leverage on day trades, and overnight borrowing power up to 2X.

- Webull is planning to offer trading in cryptocurrencies in the near future.

Disadvantages:

- Investment options are limited to stocks, options, ETFs, American Depositary Receipts, and certain cryptocurrencies (coming soon). They do not offer mutual funds, foreign stocks, over-the-counter stocks, bonds, futures, or FOREX.

- Webull is designed primarily for intermediate or advanced investors, not new investors.

- There is no availability of joint taxable accounts, or trust or custodial accounts.

- Deposits into your account must be made manually; recurring deposits are not available.

- Webull does not support fractional shares.

- Not available to non-US residents.

- To open an IRA account, you must first open a taxable brokerage account. The IRA can be opened only once the brokerage account has been approved.