Is Personal Capital Legit?

Personal Capital is trusted by more than 2.5 million users of the free app. But it also has more than 24,000 clients in all 50 states with a combined total of $12.3 billion in assets under management. Since people tend to “vote with their feet”, that kind of engagement by millions of users makes a powerful statement on whether or not Personal Capital is legitimate.

Personal Capital has a Better Business Bureau rating of “A”, which is the second-highest on a scale of A+ to F. It also has a rating of 4.7 out of 5 stars by more than 25,000 users on The App Store, and 4.4 out of 5 stars by more than 13,000 users on Google Play.

Personal Capital Review: How it Works

Personal Capital is often confused with robo-advisors. But it isn’t a robo-advisor because it includes live human investment advisors.

In truth, Personal Capital is something of a hybrid between traditional human-guided investment advisories and robo-advisors. You get the benefit of personal investment advice from live advisors, but at a fee structure that sits about halfway between traditional advisors and robo-advisors.

But another factor that separates Personal Capital from both robo-advisors and traditional investment advisors is that they offer several service levels.

Personal Capital (Free) Financial Dashboard

The Financial Dashboard is available for anyone to use free of charge. It works as a financial aggregator, similar to Mint and other apps. You can link all your financial accounts – bank accounts, investment accounts, loans, credit cards, and your mortgage – so all your financial information will be visible on a single platform.

The Financial Dashboard offers the following tools:

Net Worth:

Because you’ll have all your savings and investment accounts included in the app, as well as debts and other obligations, you’ll be able to regularly track your net worth. That’s probably the single most important number in your financial profile since it indicates the most basic level of your financial health. And because you’ll be able to track your net worth, you’ll be in a better position to increase it going forward.

Savings Planner:

You can use this tool to track your progress in saving for any purpose. That could be anything from building an emergency fund, to paying down debt, to planning your annual retirement savings.

Retirement Planner:

Though it works similar to the Savings Planner, the Retirement Planner focuses specifically on your retirement. It will look at where you are, where you want to be with your retirement savings, and help you get there in the shortest amount of time. It can even enable you to run different scenarios – like retiring earlier, making larger contributions, or incorporating anticipated large expenses and changes in income.

Investment Checkup:

You can use this tool to analyze your current portfolio allocation and compare it with an ideal target allocation designed to minimize risk and maximize returns. It’s designed to help you reach your financial goals.

Fee Analyzer:

This tool can analyze fees charged by mutual funds, retirement plans, and investment accounts. Since those fees are not always visible to the naked eye, the analyzer will let you know exactly what you’re paying for each account or individual investment fund. It will also enable you to find alternative ETFs or index mutual funds to replace your high cost actively managed mutual funds.

Because Personal Capital is a financial aggregator, it can also be used for budgeting. You’ll have all your transactions available to be automatically organized by date, category, and even vendor. You can set monthly spending targets and track your progress in reaching them.

However, be aware that Personal Capital is not a full-service budgeting app. For example, it doesn’t provide automatic bill payment capability.

GET STARTED WITH PERSONAL CAPITAL

Personal Capital Wealth Management

This is the hands-on investment management service provided by Personal Capital. It offers complete and personal portfolio management by human investment managers who make extensive use of technology, similar to robo-advisors.

Personal Capital uses what they referred to as The Personal Strategy. It uses a combination of four techniques:

Smart Weighing:

Personal Capital limits your exposure to any one sector, size or investment style, to achieve greater diversification and balance. The strategy is designed to protect against downside risk.

Tax Optimization:

This strategy involves what is known as tax location. Investments are held in accounts that will minimize tax liability. For example, high-yielding securities are placed in tax-sheltered accounts, while investments likely to produce capital gains are held in regular taxable accounts. There, they’ll get the benefit of lower long-term capital gains tax treatment.

Intelligent Rebalancing:

This is an ongoing process to enable you to buy low and sell high while remaining well-diversified. Once your target asset allocations are established, rebalancing will take place whenever those allocations depart significantly from their targets.

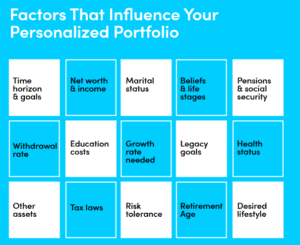

Dynamic Portfolio Allocation:

Your portfolio target allocations will be adjusted as your circumstances change. For example, as you move closer to retirement, your bond allocation will be increased to provide a greater emphasis on income and capital preservation.

Personal Capital offers five different portfolio strategies, based on your risk tolerance, investment time horizon, goals and other factors.

The strategies include:

- Aggressive

- Growth

- Moderate

- Balanced

- Conservative.

Your portfolio will be invested in the following asset classes:

Source: https://www.personalcapital.com/assets/whitepapers/Personal_Capital_Investment_Strategy_v2.pdf

Unlike most investment management services, Personal Capital publishes its investment performance:

| Type | YTD through 6/30 | 1 Year Annualized | 3 Year Annualized | 5 Year Annualized | 7 Year Annualized | Since Inception Annualized |

|---|---|---|---|---|---|---|

| Full Growth | ||||||

| Composite Personal Strategy | -7.8% | -0.3% | 4.9% | 6.0% | 6.9% | 9.7% |

| Comparative Benchmark | -5.7% | 2.0% | 5.9% | 6.1% | 7.3% | 9.3% |

| GROWTH | ||||||

| Composite Personal Strategy | -6.4% | 0.5% | 4.8% | 5.6% | 6.3% | 8.7% |

| Comparative Benchmark | -4.1% | 3.0% | 5.9% | 5.9% | 6.8% | 8.4% |

| BALANCED GROWTH PLUS | ||||||

| Composite Personal Strategy | -5.0% | 1.2% | 4.6% | 5.2% | 5.6% | 6.8% |

| Comparative Benchmark | -2.4% | 3.9% | 5.8% | 5.6% | 6.2% | 6.9% |

| BALANCED | ||||||

| Composite Personal Strategy | -3.2% | 2.1% | 4.4% | 4.7% | 4.9% | 5.8% |

| Comparative Benchmark | -0.9% | 4.7% | 5.6% | 5.2% | 5.5% | 6.0% |

| BALANCED STABILITY TILT | ||||||

| Composite Personal Strategy | -2.0% | 2.7% | 4.2% | 4.2% | 4.4% | 5.0% |

| Comparative Benchmark | 0.3% | 5.2% | 5.4% | 4.9% | 5.0% | 5.2% |

Personal Capital offers three different investment plan levels: Investment Services, Wealth Management, and Private Client. The three services are summarized below:

Investment Services

This service level is designed for investors with between $100,000 and $200,000 in investment assets.

It offers the following services:

- Financial planning tools

- Access to a financial advisory team

- Financial and retirement planning

- Investment review

- Personal Strategy and Smart Weighing

- Portfolio monitoring and rebalancing

- Tax optimization

- Investing in exchange traded funds (ETFs)

Wealth Management

Wealth Management is designed for investors with between $200,000 and $1 million in investable assets. It has all the services provided under Investment Services, but adds the following:

- Access to two dedicated financial advisors (rather than to a financial advisory team)

- Access to specialists

- Financial decisions support, including insurance, home, finance, stock options, and compensation

- Portfolio customization

- Investment in individual stocks, in addition to ETFs

Private Client

Private Client is available only to investors with over $1 million in investment assets. It’s a highly specialized service level, that provides all the same features as Wealth Management, but adds the following:

- Access to the investment committee

- Wealth planning, including estate, tax and legacy planning

- Private equity and hedge fund review

- Access to private banking services

- Estate, tax and legacy portfolio construction

- Investments in individual bonds and private equity investments, in addition to stocks and ETFs

Socially Responsible Investing (SRI)

With SRI you’ll invest in companies that are proactive in managing environmental, social and corporate governance (ESG) related issues. That will give you an opportunity to invest in companies with greater employment diversity, more reasonable executive compensation, and a greater emphasis on climate change, renewable energy, and sustainability, among other metrics.

SRI uses all the same investment strategies as the plan levels above, but incorporates an emphasis on companies focusing on ESG, rather than the general market. For example, there will be no investments in your portfolio invested in tobacco, adult entertainment, gambling, or small arms. And energy sector investments may focus on renewability, rather than fossil fuels.

You can apply SRI to the Investment Services, Wealth Management and Private Client plan levels.

Personal Capital Cash

Personal Capital Cash is an interest-bearing account where you can hold large cash balances. Accounts can be opened for either individuals or jointly.

The account is offered through UMB Bank since Personal Capital itself is not a bank. However, there are several participating program banks operating through UMB Bank. This is why Personal Capital Cash can provide FDIC insurance of up to $1.5 million per depositor.

For example, the FDIC limit is $250,000 per depositor, per bank. By spreading $1.5 million across six partnering banks, you’ll be able to take advantage of full FDIC coverage on the entire amount.

Personal Capital Cash is paying a current annual percentage yield (APY) of 0.05% on all balances. However, if you are a Personal Capital Advisory client, the APY rises to 0.10%.

You can use Personal Capital Cash to set up direct deposits, link to your checking account to pay monthly bills, and withdraw up to $100,000 per day. You can even wire up to $1 million with no fees.

One major advantage with Personal Capital Cash is that there is no limit to the number of deposits or withdrawals you can make through the program. (The usual limit is six withdrawals per statement cycle on savings accounts and money market accounts.)

Is Personal Capital Safe?

Personal Capital using the following measures to protect your information and identity:

- Regular scanning and testing of company systems for security issues.

- Layered defense in-depth approach.

- Strong data encryption that’s rated more highly rated than most major banks and brokerages.

- Strict internal controls – no one at Personal Capital has access to your credentials.

- Fraud detection, monitoring and alerts.

- Robust authentication including dual authentication.

- Partnership with Yodlee, where all your financial credentials are stored, to facilitate aggregation of your accounts.

If you use Personal Capital Wealth Management, your funds will be held with Pershing Advisor Solutions, one of the largest asset custodians in the world with almost $2 trillion in funds in custody.

Is Personal Capital Free?

The answer to this question is both yes and no. The Financial Dashboard is available at no charge to you. But if you choose to use Personal Capital Wealth Management, the following fee structure will apply:

- The first $1 million: 0.89%

- The first $3 million (for accounts greater than $1 million): 0.79%

- Next $2 million: 0.69%

- Next $3 million: 0.59%

- Over $10 million: 0.49%

How Does Personal Capital Make Money?

Personal Capital earns its income on the annual advisory fees paid by Wealth Management investors. And though the basic version is free to use, the company will solicit you to join the paid version.

Of course, that won’t be possible until you have at least $100,000 to invest. But Personal Capital may be providing the free version to help small investors reach the $100,000 level so they can take advantage of the premium service.

Personal Capital Pros & Cons

Pros:

- There is no cost to use the Financial Dashboard to aggregate and track your entire financial life in one place.

- Personal Capital provides personalized investment management at fees well below traditional human investment advisors.

- On portfolios of $200,000 or more, you can invest in individual stocks as well as ETFs. On portfolios greater than $1 million, you can also add bonds and private equity.

- Wealth Management gives you access to live financial advisors on all portfolios of $100,000 or more.

- The Socially Responsible Investment is available for all three plan levels.

Cons:

- The Financial Dashboard provides only limited budgeting capability.

- You’ll need a minimum portfolio of $100,000 to take advantage of the investment management services.

- Though the annual advisory fee – at 0.89% for most investors – is below what is charged by traditional human investment advisors, it’s well above the 0.25% typically charged by robo-advisors.

- Personal Capital Cash pays very low interest rates even on high savings balances. It’s not competitive with high-yield online savings accounts.

- If you sign up for the free Financial Dashboard, you’ll frequently be solicited for the premium service.